BRI e-commerce bright spot in a glum trade story

PRC trade faces a litany of woes: contracting global demand, rising trade protectionism, high-tech decoupling and low-cost industry relocation. It shrank by around 10 and 14 percent in June and July 2023, respectively and may tumble further in H2 2023. Yet trade with BRI (Belt and Road Initiative) countries remains resilient, as does CBEC (cross-border e-commerce).

Several factors favour Silk Road e-commerce. Friction with the West has pushed Beijing closer to its BRI trade partners. CBEC giants, seeing trade slip in mainstream US and European markets due to decoupling pressure and falling demand, are seeking out BRI shoppers. This delivered a sizable uptick (some 20 percent) in Latin America and Southeast Asia in 2022.

Value-for-money BRI food and groceries are in demand among PRC consumers, as are low-cost PRC appliances, digital goods, home furniture and clothing items in BRI partner countries. These were also the main CBEC exports and imports of the PRC in H1 2023, reports Chinese Customs.

Given the complementarity between PRC and BRI CBEC trade, further growth may be expected. Trade with BRI states has doubled over 2013–22 and now accounts for nearly half of the PRC’s total trade volume. Trade reached some C¥8 tn, a y-o-y growth in Jan-May 2023 of 10 percent (a 5.4 percent lead over the total trade volume in the same period). Exports to these states now reach C¥4.42 tn while imports are at C¥3.46 tn, accounting for roughly 46 and 48 percent of total exports and imports, respectively.

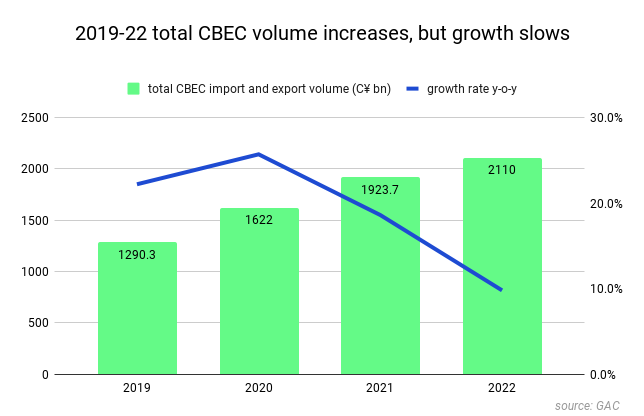

Meanwhile, CBEC volume with all global partners has steadily risen to over C¥1 tn in H1 2023, a 16 percent growth y-o-y, reports PRC Customs. It now accounts for some five percent of total trade, a marked increase from just one percent five years ago. CBEC has untapped potential to drive trade growth despite global headwinds, insists Long Yongtu 龙永图 Global CBEC Conference.

Drawing on BRI and CBEC growth, the heavily promoted ‘Silk Road e-Commerce’ is an arm of the broader ‘Digital Silk Road’ vision. It reappeared in the 20th Party Congress Report in 2022 and the 2023 layout plan for digital China construction.

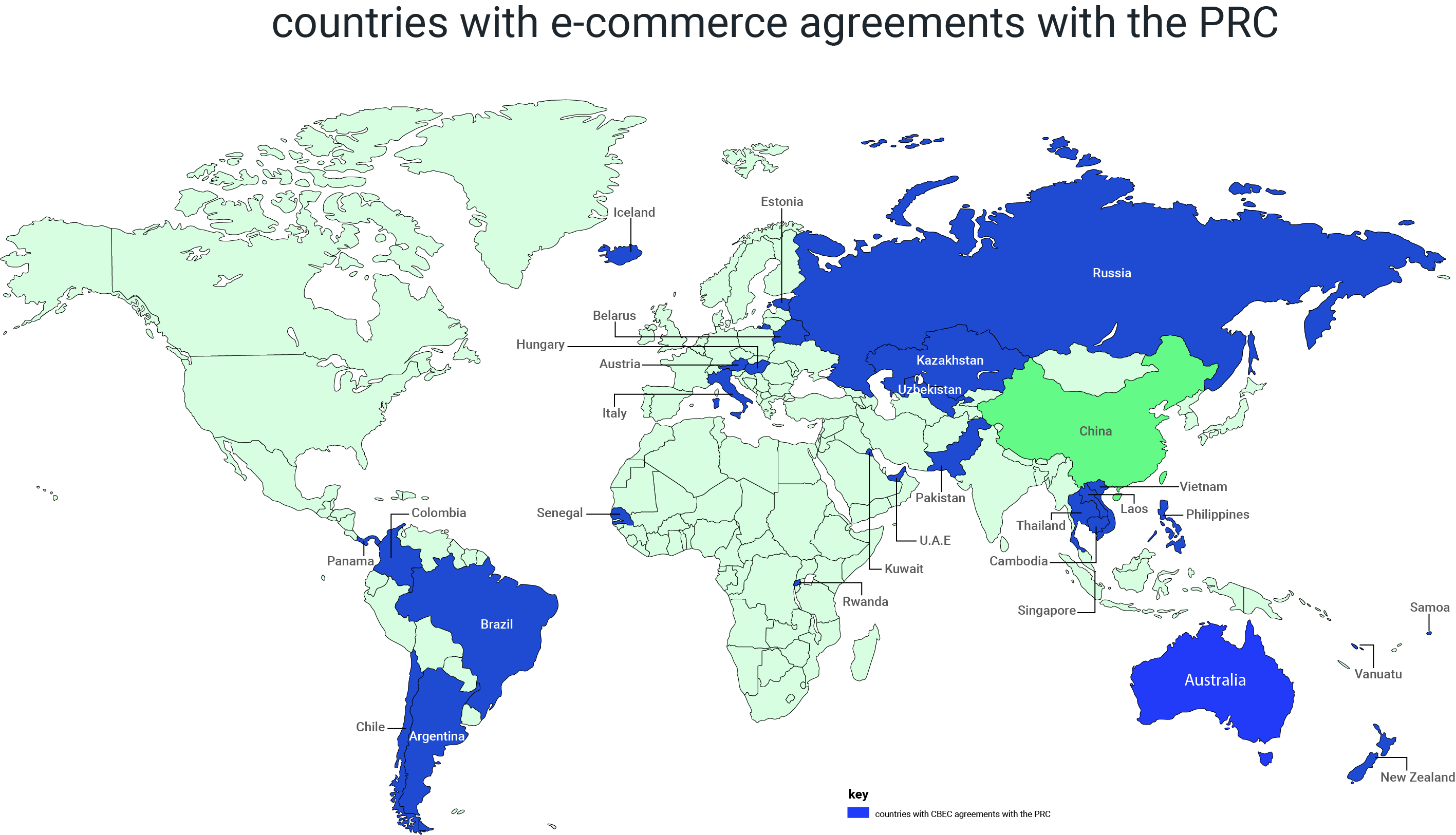

Beijing has signed e-commerce agreements with some 30 states, creating a ‘blue ocean’ for CBEC. E-commerce is a growing component of the BRI, argues Li Chenggang 李成钢 China’s WTO ambassador and former MofCOM deputy minister.

the new multiplier

Unlike conventional goods trade, CBEC is a multiplier: promoting emerging satellite industries in logistics, finance, online payment, insurance, live streaming and consulting services. Planning in these sectors will give PRC firms an upper hand, argues Wang Xiaodong 王晓东 Renmin University of China School of Business.

CBEC giant Pinduoduo now has an overseas support program providing integrated CBEC solutions for manufacturing firms in warehousing, cross-border logistics, and after-sales. Yet these satellite services in the PRC are not up to scratch and should be further promoted, urges Long so that the PRC can offer complete CBEC supply chains.

Equally pivotal for developing CBEC in the BRI are infrastructure and policy support. A recent ICBC International study suggests the overall quality of infrastructure there has risen, lowering trading costs and boosting LDCs’ GDP.

win-wins

Chinese CBEC and logistics firms like JD.com, J&T Express, Alibaba Group and Best Inc are unfolding networks and delivery services abroad. ‘National pavilions’ (nationally-themed CBEC online sites typically paid for by Beijing-based embassies) on JD.com claim to have reached over 1.5 bn people annually, building up over 10 million active users. New CBEC trends include featuring BRI diplomats promoting their country's goods online and e-commerce weeks and festivals dedicated to Silk Road products. Expanding imports to strengthen economic ties with BRI partners fits well with Beijing’s need to reduce a ‘passive' trade surplus, deemed a source of trade tensions with partners.

digitally enabled

CBEC entails installing digital infrastructure, such as fibre-optical cable, 5G base stations, and data centres. Reinforcing these is, says MofCOM, one of four key priorities set by the PRC–Central Asia Summit. Mutual recognition of standards, added the spokesperson, is vital to cross-border interoperability. Compared to advanced countries, the PRC still has much to catch up in high-end digital services like cloud computing, AI, blockchain etc.

all streams lead to Yiwu

real world wholesale stores in Yiwu, Zhejiang

real world wholesale stores in Yiwu, Zhejiang

Nicknamed the ‘world’s supermarket’, Yiwu was approved as a CBEC pilot zone in 2018 and houses a massive consumer durables wholesale market, attracting crowds of Middle Eastern and African merchants.

Some weeks ahead of the Central Asia summit, a 'BRI international data centre' was announced in Yiwu. Jointly developed by Zhejiang China Commodities City Group (the state-owned company operating the Yiwu market) and Zhejiang Unicom, investment for the project's first phase will total C¥1.8 billion.

Comprising 120,000 virtual CPUs, the centre will reach a computing capacity of 50 Pflops, with an internet bandwidth of about 2T. Along with AI-driven supply-chain optimisation and cross-border finance, the new data centre will power e-commerce live-streaming; a C¥1.2 trillion business in the PRC, now expanding abroad. As the sector moves to AI-powered virtual broadcasting, demand for computer power will only grow.

Yiwu's online site, Chinagoods.com, was launched in 2020. It boasts connecting 75,000 physical stores, services 2 million SMEs and has operations in Spain, Colombia and elsewhere.

Yet the overall development and progress in value-added services at Chinagoods.com fall below expectations, warns Caitong Securities. Online settlements still depend on overseas agencies, charging high service fees. YiwuPay, launched in February 2023, has processed very few payments and is unlikely to make much difference in the short term.

aspiring to write CBEC rules

As tensions with the West mount, the CBEC sector is feeling the impact. PRC e-commerce giant Shein and other online retailers are recent targets of a US Congressional Commission, citing labour and IP concerns.

The PRC is loth to lose established CBEC markets in Europe and the US, given their size and volume. But it may be tricky to balance both established markets and BRI aspirations. Trade mounting with a given bloc may entail it declining with others, argues Zhang Yansheng 张燕生 China International Economic Exchange Centre. Trade with BRI may also not make up for as much of the shortfall in trade growth as Beijing has hoped, given BRI markets have smaller volumes, lower profitability and higher risks, he adds.

Although support policies are in place, issues such as mounting competition, poor infrastructure, and local protectionism (e.g. in online payment and delivery) will persist. Logistics, warehousing, payment settlement, financing and regulatory compliance etc. are further barriers. Overcoming these problems demands proactive measures from Beijing. The state, advises Yi Xiaozhun 易小准 former WTO deputy director-general, should strengthen ‘top-level design’ and planning. To attract and retain customers with higher-quality goods and navigate new tech trends, CBEC firms are urged to focus on branding.

Given the lack of global rules on digital trade, fostering cooperation on BRI e-commerce can help project Beijing's voice in shaping these rules to its benefit, argues Lao Guoling 劳帼龄 Shanghai University of Finance and Economics. The PRC should take a more prominent role in setting rules in areas in which the PRC has advantages, like e-commerce, echoes Long Guoqiang 隆国强 State Council Development Research Centre.

For Beijing, this vision could include referencing RCEP principles that ensure flexible public policy and security interests while opening cross-border data flows and curbing data localisation. Beyond BRI, the PRC is actively drafting global e-commerce protocols. This is happening in various WTO negotiations, 11 of its free trade agreements, the Shanghai Cooperation Organisation and BRICS (Brazil, Russia, India, China, South Africa). In turn, Beijing deems this experience positive for its bids for membership of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership and the Digital Economy Partnership Agreement.

CBEC and trade policy voices

Lao Guoling 劳帼龄 | Shanghai University of Finance and Economics E-Commerce Research Centre director

CBEC platforms, argues Lao, optimise spillover benefits for Silk Road e-commerce. It is becoming a complex network that encompasses ‘buying from the world’, ‘selling to the world’, B2C, B2B, professional services, upstream production and downstream consumption. Online platforms enable direct response to market dynamics, shortening the journey from production to consumption. She adds that online payment abroad via Chinese CBEC platforms benefits RMB internationalisation.

A professor at Shanghai University of Finance and Economics, Lao heads its E-Commerce Research Centre. An engineer by training, She received her doctorate in management science and engineering from Donghua University, specialising in e-commerce. She works on digital infrastructures, technology, information management and e-commerce security.

Long Yongtu 龙永图 | Global Cross-Border E-commerce Conference chairman

Global demand remaining sluggish, CBEC will help restore international trade vitality, argues Long. Weak in services trade, the PRC may find a breakthrough point in CBEC to take such services as cross-border logistics, live streaming, payment settlement, and cross-border global legal services. Long advises strengthening international cooperation to break down trade barriers for e-commerce, while safeguarding consumer rights and IP.

Veteran trade diplomat Long is a former MofCOM vice minister and chief negotiator in accession to the WTO. He chairs the Centre for China and Globalisation Advisory Council and the PRC-organised Global CBEC Conference.

Yi Xiaozhun 易小准 | former WTO deputy director-general

Slowing economic growth offers new opportunities for CBEC, argues Yi. With its massive growth market for CBEC (cross-border e-commerce), the PRC is meanwhile the largest CBEC exporter with the largest B2C market for e-commerce. CBEC helps anchor PRC foreign trade, preserving orders, markets and market share. Now the PRC's fastest-growing foreign trade mode, CBEC’s growth rate is more than double that of global rivals. Three areas Yi suggests receive focus are

- paperless trade

- building overseas warehouses

- investing in BRI e-commerce infrastructure

Yi was central to Beijing’s pre-accession negotiations. Following accession, he took charge of WTO affairs in MofCOM, rising to vice minister. He served two four-year terms as WTO deputy director until 2021.

context

17 Jun 2023: PRC submits official documents to join CPTPP

27 Feb 2023: CCP Central Committee and State Council issues 'Overall layout plan for digital China construction', emphasising building 'Digital Silk Road' and actively developing 'Silk Road E-commerce'

1 Nov 2021: the PRC applied to join DEPA

14 May 2017: inaugural BRI forum at which President Xi Jinping, for the first time, calls for digital silk road development

28 Mar 2015: digital silk road mentioned for the first time in a whitepaper by National Development and Reform Commission, Ministry of Foreign Affairs and Ministry of Commerce