making nicer on FDI

The Two Sessions made much of renewed action on FDI (foreign direct investment). We were also told that more foreign investment comes from BRI (Belt and Road Initiative) partners, while more FDI flows into high-tech sectors.

The tone was not one of just Two Sessions publicity but of delivering financial oxygen to the macroeconomy.

The meeting was inclined to dismiss a just-reported 82 percent y-o-y fall in 2023—the worst figures for FDI in two decades. Pledging greater market access and genuine ‘national treatment’, the Government Work Report addressed international firms’ concerns: standard-setting, data flows, better visa conditions, etc.

Taking on board a raft of complaints from domestic actors about foreign investment disconnects, the centre has been steadily rolling out investment-friendly measures—just as it puts local officials on notice to carry them out.

expert prescriptions

In explaining the FDI downturn, global commentary mainly notes geopolitical decoupling, Beijing’s overarching security agenda, and high US interest rates deterring investment into the PRC. Along with these home truths, Beijing experts point to deeper structural elements. The Two Sessions echo this shift in mindset.

Jiang Xiaojuan 江小涓 China Society of Industry Economics, argues that PRC interaction with global firms is changing with the evolving landscape. The current so-called adjustment phase features

- declining role of foreign capital

- PRC firms need FDl less, given the rise of local capital markets

- mature domestic rivals edge out foreign firms in home appliances, communication equipment, construction equipment, LED panels, e-commerce, etc.

- shift from complementarity to rivalry with overseas players

- fewer essential items lie beyond the capacity of PRC manufacturing

- mounting labour costs due to rising PRC incomes

To cope with these shifts, the PRC's market scale and almost complete industry chains should be prime attractions for foreign business investment, added Jiang.

While the PRC may no longer depend on FDI for capital, global firms' know-how, technology and market discipline are vital for the country to keep moving up the industry chain. She often repeats that the PRC needs to keep working with international partners.

Given US tech embargoes and mounting rivalry with Southeast Asia in labour-intensive exports, industry upgrading is pivotal, requiring as much global input as can be mustered. Linkage with foreign interests opens their markets and imposes a higher price for them to decouple from the PRC. Liu Yuanchun 刘元春 Shanghai University of Finance and Economics argues Beijing's trade policy needs to align with industry planning; a more 'structural and political’ approach is required.

Beijing’s response

While publicly talking up current successful FDI, Beijing is, at the same time, putting foreign investment at the centre of its economic and trade agenda. The State Council dubbed this as ‘an important focus for 2024 economic work’. A host of FDI support policies were issued in H2 2023, including

- enacting 24 measures prefigured in August 2023 State Council opinions

- retaining education, housing and other tax breaks for expats; tax rebates for equipment bought by foreign-funded research institutions

- pressure to reduce controls of cross-border data flows that discourage foreign firms

- Lingang pilot for selectively licensing specific data flows, e.g. ICVs, finance, shipping and biomedicine

- making nice with foreign enterprise

- roundtables and complaint hotlines

- encouraging engagement in PRC standard-setting

- a campaign to improve discrimination against foreign investment/FDI (e.g. cumbersome red tape)

- tax breaks on equipment imported by foreign firms for use in state-supported projects

Much has been promised on paper, but European, Japanese and US Chambers of Commerce hope the rollout will be effective.

beyond FDI

Yet, investment-friendly policies do not address many of the root problems.

Huo Jianguo 霍建国, China Society for WTO Studies, always an astute commentator, notes that state agency malpractice, rather than laws or policies, distorts the playing field. Levelling the field entails reining in central and local actors. Efforts to this end have recently included clipping local tax incentives and addressing unfair market intervention via local subsidies.

Ending bias against foreign capital is urgent, insists Yao Yang 姚洋 Peking University National School of Development. Investment of all kinds must be boosted if the PRC business environment is to improve. A level playing field would raise everyone's game, agrees Jiang Xiaojuan. Steps to this end encompass

- cleaning up arbitrary regulation and intervention in commerce

- ending the ‘fines-based economy'

- unifying the national market

- action by NDRC and SAMR to

- promote the unified national market and rectify arbitrary intervention

- address local protectionism and administrative monopolies

- boosting transparency in state procurement, tendering and bidding

areas to watch

Foreign capital will flow into sectors that are 'not yet reformed' and are less competitive—like services—suggests Jiang. Zhang Yansheng 张燕生 China International Economic Exchange Centre adds that while the PRC does not lack capital, it lacks a financial system that can convert the country’s high savings into effective investments. Financial markets are weak, as is PRC regulatory capacity. Private and foreign firms account for barely ten percent of the financial sector (compared to 70 percent in manufacturing). Zhang argues that further opening up the sector to foreign investment is vital. Foreign participation in the financial sector would improve the market's mechanisms and maturity by bringing competition, pleads Dong Zhongyun 董忠云 ACIV Securities.

The 2023 Central Financial Work Conference urged building a financial ‘major power’ more open to business. NAFR (the National Administration of Financial Regulation) recently launched 50 measures, apparently ending restrictions on foreign ownership and lowering market access thresholds. Bilateral sovereign wealth funds' cooperation with GCC (Gulf Cooperation Council) countries is expanding, with five major funds growing their PRC exposure. By one estimate, their input may grow to US$10 tn by 2030. Such funds are not only massive in volume but also patient. Directing them into securities would hopefully restore confidence in the ‘involution-prone’ domestic sector.

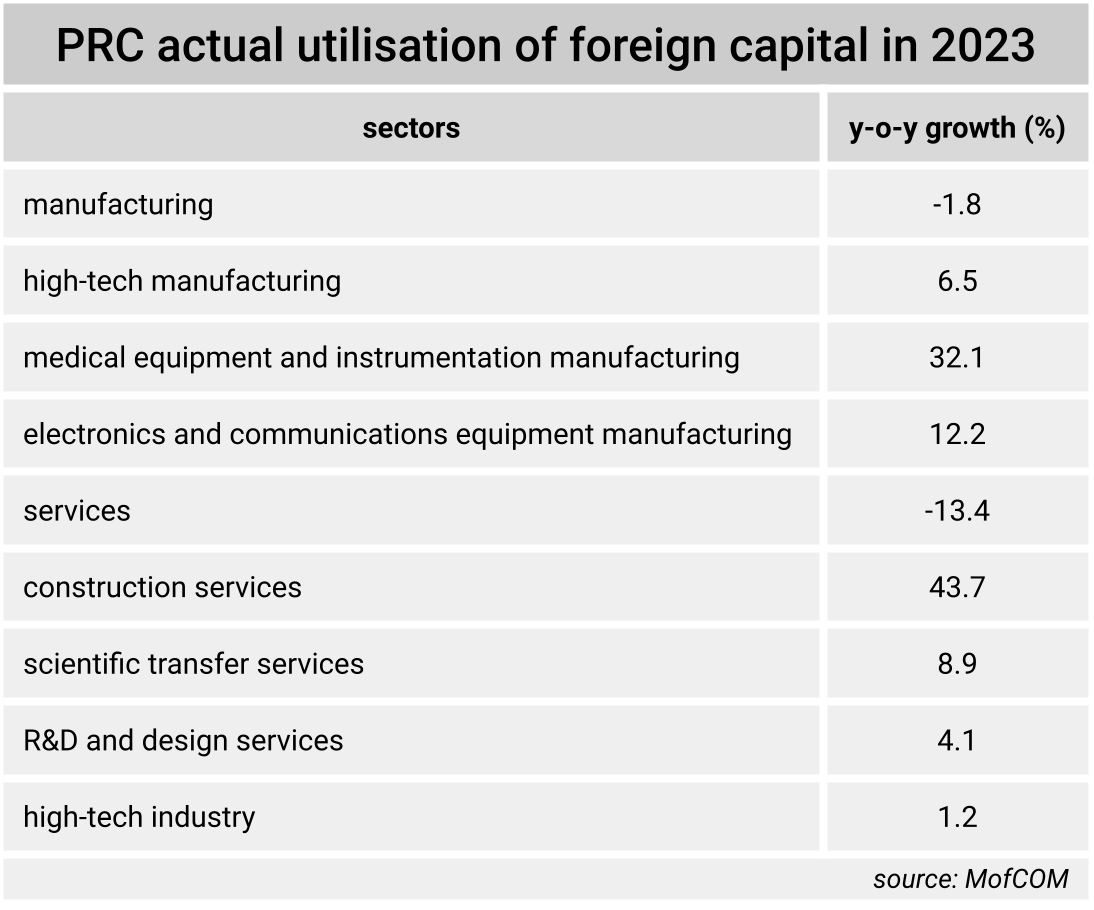

High-tech policy is not going off the boil: foreign skills remain imperative for competitiveness. NDRC published a list of sectors the PRC deems especially open to FDI: biomedicine, autos, new energy batteries and advanced chemicals. ‘Sponge cities’, green energy, large aircraft, and healthcare retirement have considerable scope for investment, insists Yu Yongding 余永定 CASS (Chinese Academy of Social Sciences). These are also sectors seriously growing in 2023, MofCOM figures reveal.

The IW Institute (Köln) reports that Germany invested a record €12 billion in the PRC in 2023. Autos and advanced manufacturing remain top recipients. MofCOM reports that investment from France, the UK, Switzerland, the Netherlands, and Australia rose in 2023. Firms newly set up for direct investment from BRI (Belt and Road Initiative) countries grew over 80 percent year over year.

profiles

Jiang Xiaojuan 江小涓 | China Society of Industrial Economics president and former State Council deputy secretary-general

Jiang argues that the PRC still needs external resources for vital factors of production. She adds that barriers to further opening must be overcome, noting that high-level opening remains critical to the PRC’s position in the global division of labour.

A Chinese Academy of Social Sciences research professor, Jiang is a veteran trade expert. She has held high-level posts across academia and government. She was the former Dean of Tsinghua University‘s School of Public Policy and Management. She also served as a State Council deputy secretary-general, National People's Congress Standing Committee member and Vice Chairperson of the NPC Social Construction Committee.

Zhang Ning 张宁 | CASS (Chinese Academy of Social Sciences) International Economics and Trade Research Office researcher

Quality should be prioritised over quantity in foreign investment, contends Zhang. Attracting cutting-edge technology to the PRC will be vital to the country’s industrial upgrading, short and long-term, he adds. This implies, argues Zhang, high-tech aspects in traditional industries, not just high-tech industries themselves, citing gene-editing and breeding in agriculture.

An economics PhD by training, Zhang focuses his research on investment and international trade at the CASS Faculty of Applied Economics. He has chaired and taken part in over 30 major projects funded by the National Social Science Fund, MofCOM, GAC, etc. Several of his projects were submitted to the State Council and other government departments after receiving outstanding research awards.

Yao Yang 姚洋 | Peking University National School of Development former dean

Commenting on foreign investment exiting the PRC, Yao notes that most exiting are US firms, subject to heavy pressure and sanctions. He notes rising foreign investment from countries with other advanced economies, e.g., France and Germany. He argues that foreign firms will return if the PRC remains committed to its opening policy.

Yao received his PhD in development economics from the University of Wisconsin. He has served as Dean of Peking University National School of Development, the China Centre for Economic Research director, and the Institute of South-South Cooperation and Development.

As an active columnist in news media, Yao has also published over 100 papers in domestic and international academic journals.