As people struggle to find medicines in the chaos of COVID, many were betting on a further price cut for Paxlovid, the Pfizer antiviral reportedly selling for C¥10,000 per pack due to limited supply. But price negotiations failed, so it will not be available through the Basic Medical Insurance (BMI) scheme.

annual update

Launched in 2000, the NRDL (National Reimbursable Drug List) was revised in 2004 and 2009. It approved just 100 new drugs up to 2016. The scheme was revamped in 2017, when 36 new drugs were added, and has since been revised annually.

Denied life-saving new drugs available outside the PRC, patient pressure had boiled over in the mid-2010s. In 2018 a popular movie Dying to Survive, revealed the plight of a leukemia sufferer who smuggled generic drugs from India for himself and others. The movie is said to have prompted Li Keqiang 李克强 to call for more access to affordable drugs.

As of January 2023, some 3,000 different medicines are listed, running from diabetes management, and anti-cancer drugs to rare disease treatments. Reimbursement is however variable: inexpensive Category A medicines are fully reimbursable, while patients still need to pay the gap for costlier Category Bs. Rates vary at the provincial level based on available funding.

Easing patient costs, the NRDL can unlock gains for pharma companies. Dramatic sales growth will typically follow NRDL inclusion. To get on the list, though, prices must be discounted. The past five rounds (2018-22) saw price reductions near 60 percent on average. But growth prospects may be temporary if further discounts are needed to stay on the list.

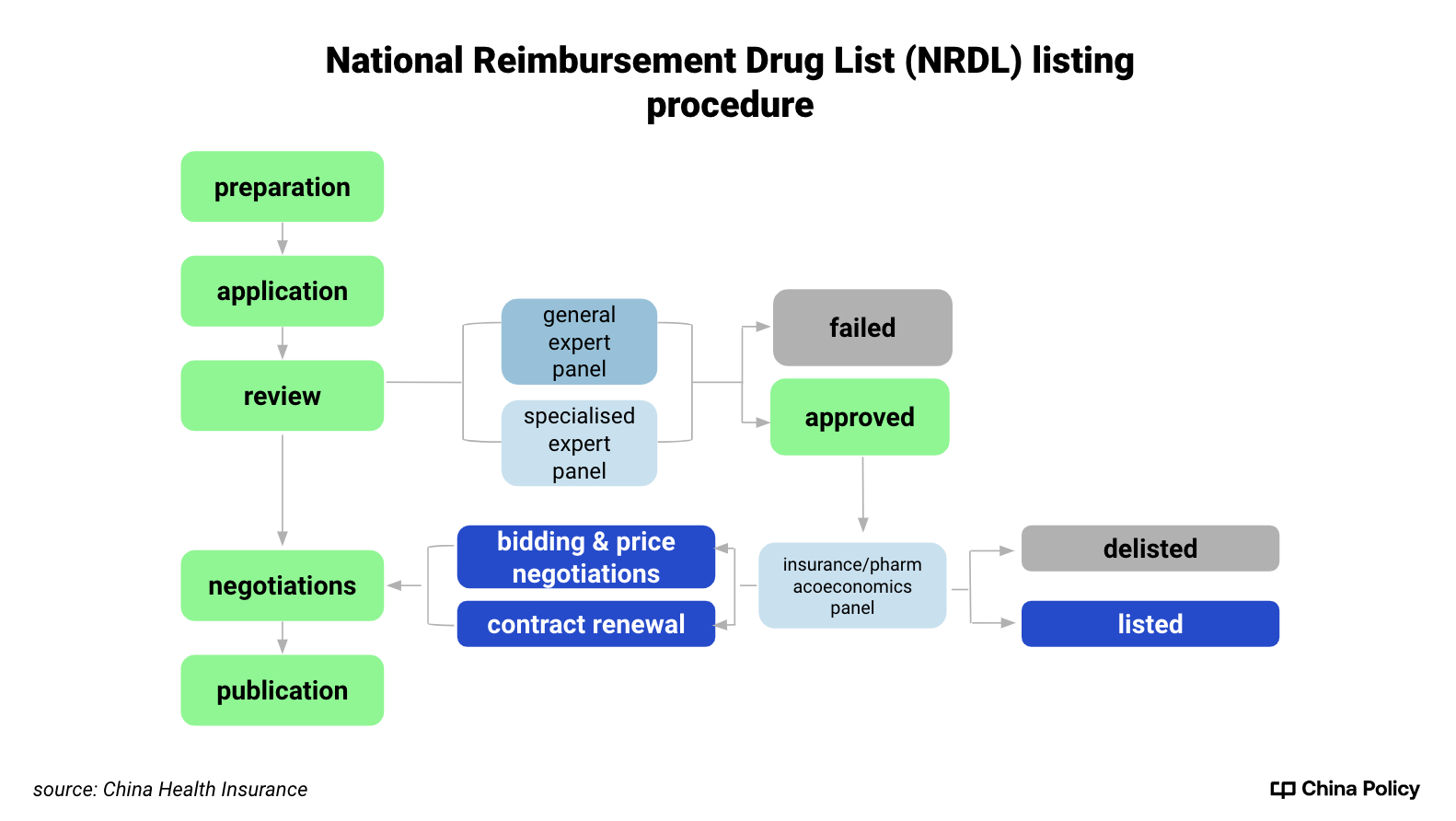

NHSA (The National Healthcare Security Administration), the largest provider of insurance reimbursements, organises annual updates (see chart below). Official target prices for negotiations and contract renewal are set by expert panels who consider

- clinical value and innovation

- financial impact on the BMI fund

- affordability and profitability

- international reference pricing

Drugs may qualify to be added to the list without further negotiation—or removed from NRDL if, for instance, there are better alternatives for treating the same disease.

revising rules

Launch of the process yielded severe price cuts, some falling by over 70 percent, reports Caixin, cutting profits to the bone. Sales impact aside, major price drops affect profits, potentially impacting future R&D by pharma firms and patient access to innovative treatments. After some bruising initial rounds, some global firms withdrew from the scheme.

Steep price cuts remain on the cards for generics, but new rules in 2022 now support innovation, ensuring that prices will not be cut. Drugs without generic competitors (as long as their past revenue and estimated future profit are BMI budget neutral), will not need to negotiate new contracts. Their prices are unlikely to change for the next contract cycle. Innovative drugs addressing a wider range of illnesses are expected to benefit from a moderate price rise.

Treatment of rare diseases has been another theme since 2021. Scrapping a restriction approved in early 2017 on drugs for rare disease, more candidates are eligible to apply this year. Yet given that the state only ‘secures the basics’, patients will still be seriously out of pocket. Chances for NRDL inclusion will be slim for treatments costing over C¥300,000 p.a.

changing landscape

As local pharma firms improve their R&D and provide cheaper alternatives, price competition for overseas players is ever tougher. Innovative drugs added to NRDL by domestic pharma accounted for over 60 percent of additions in 2021, surpassing those from global manufacturers for the first time.

Anti-cancer treatment via PD-1/PD-L1 inhibitors is another case in point. NRDL has favoured locally developed alternatives; no global brand—Roche, AstraZeneca or Bristol-Myers Squibb—has won a listing.

NRDL inclusion of off-patent drugs will become ever less likely amid downward pricing pressure from local counterparts. To maintain their foothold in the world’s second-largest market, global pharma, including AstraZeneca and Sanofi, have pivoted to early-stage R&D in the PRC.