hit to tax and land revenues force return to off-balance sheet financing

The economy barely achieved growth in Q2, according to official data, with weak domestic demand the primary culprit. To fill the gap, the tap of fiscal spending has been eased.

Localities too are suffering under the weakening trend. Hit with tax revenue cuts and plummeting land transactions, cumulative general public budget revenue was down over 10 percent y-o-y nationally in H1. Localities are likely to return to LGFVs (local government financing vehicles) in the short term, while longer-term solutions like a real estate tax seem forever on the horizon. The current squeeze nonetheless points to its arrival.

good and bad tax rebates

Li Keqiang’s 李克强 Government Work Report (GWR) proclaimed that tax cuts and rebates were to be a major stimulus, with the target set at C¥2.5 tn. Some C¥1.85 bn in tax refunds was doled out in H1 2022, focused on SMEs. A 1 July boost added support to industries hard hit by COVID outbreaks, e.g. retail and catering. Sample surveys show tax rebate funds are mainly used to expand production and R&D, and pay salaries, noted Xie Wen 谢文 SAT Goods and Labour Tax Department.

But public budgets across the country have then been hit by falling tax receipts.

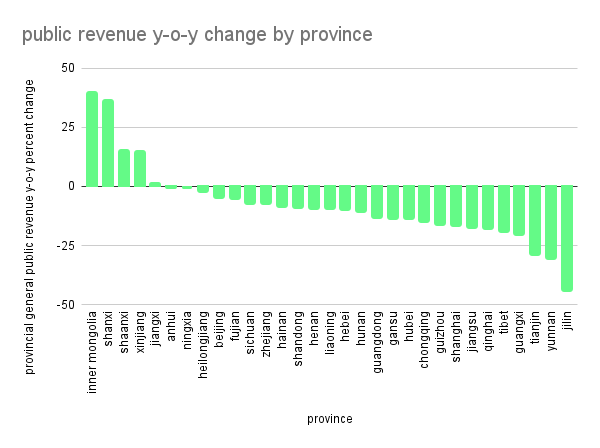

public revenue y-o-y change by province

Jilin’s receipts fell furthest at -44.2 percent y-o-y. The province endured months of lockdown, albeit its struggles did not hit the media to the same extent as Shanghai’s. Receipts in Shanghai fell some 17 percent, while Beijing, with its own style of lockdown, was down 5 percent. H1 cumulative national public budget revenue was C¥10.52 tn, down 10.2 percent y-o-y. Tax revenue accounts for 85 percent of the national public revenue, explains Zhu He 朱鹤 CF40; every percentage point decrease in annual tax revenue growth rate implies a revenue gap of C¥180-200 billion.

Heading off pressure for tax cuts, the GWR forecast transfer payments increasing by C¥1.5 tn (18 percent) to almost C¥10 tn. To this end, three funding rounds have rolled out so far (details have been provided for two of the rounds, totalling C¥800 bn). Jiangsu and Guangdong have received the most, according to the available data, at some C¥60 bn and C¥58 bn, respectively.

transfer payment funds for offsetting tax and fee cuts

land finance struggles as well

The state's revenue woes have been multiplied by the real estate drama. Land transfer revenue and fees account for the lion's share of local revenues (estimated at up to some 40 percent). With real estate developers denied bank finance, they are not buying land; localities responded by throttling back on supply with attendant loss of revenue.

Transaction volumes fell by some 22 percent by area and 29 by value in H1, despite localities' support attempts. The biggest firms are faring worse, according to private firms' research data. Sales of the TOP 100 real estate enterprises over H1 2022 dropped by 50.3 percent y-o-y, according to CRIC China, a private real estate monitoring firm. The weak real estate market has bled over into land sales. Falling market demand and soft transactions resulted in low premiums and high failure rates at land auctions in H1 2022. Total floor supply and planned floor area sold were down some 45 and 60 percent y-o-y in H1, according to Zhuge Housing Data Research Centre. NBS data show similar results: area and land sales value fell some 50 percent. Zhuge also points to the rise in LGFV and SOE participants in the land market; they made up 75 percent of land acquisitions. The trend starting in 2021, points out Caixin, is expected during market downturns. An LGFV insider told Caixin that they often lack follow-up plans to develop the land; it will return to the government, essentially roundtripping land.

In May, the transaction area of newly built commercial housing in 100 cities rose 37 percent m-o-m. Optimists claim the sector has bottomed out, but it still decreased by 34 percent y-o-y. A V-shaped recovery seems off the table: the lingering threat of lockdowns, plus rising concerns over the financial system and developers’ ability to finish projects loom over the market. Even if it improves, local governments will not be able to bank on a vibrant market to fill in funding gaps; Wang Tao 王涛 UBS estimates that falls in land transfers accounted for a C¥1.1 tn dip in revenues.

hard road ahead

How may falling revenues impact fiscal outlays? Predictions on the funding gap between budgets and actual revenues range between C¥2-3 tn. Beijing has rolled out infrastructure funding, so that is unlikely to fall; but cuts are looming elsewhere. Some localities are already reducing their 2022 budgets and shifting funding to prioritise infrastructure and healthcare. The PBoC called for more credit for LGFV in April, implying that off-balance sheet debt would likely grow without an increase in the national deficit.

Calls to end the addiction to land-finance—on the cards for the past 20 years—are not merely back, but back with added force. The expanded real estate tax pilots were postponed this year; hence, moving into H2 conversations are in train as to whether they will be rolled out in H1 2023.

Plans to update sub-provincial fiscal obligations were rolled out in hopes of better aligning funding with areas that need support. Doing so may be a first step in delegating more fiscal power to localities. Yet progress is likely to be slow: local ‘games of interest’ make wealthier areas reluctant to fund other areas. Downstream impacts, like lack of funds to pay state employee wages, will continue in 2022.

what are the experts saying?

Lin Caiyi 林采宜 | China Chief Economic Forum Research Institute vice-director

To stabilise the economy, argues Lin, it is imperative to stabilise real estate, source of some 25 percent of total fixed asset investment in 2021. Accepting that localities need to support demand by easing buying restrictions in the short-term, she insists that buyers and local governments must be placed on more solid long-term footings. Clearer property ownership rights are needed, not only clarifying buyers' expectations of future value and cost of real estate: it will lay a legal foundation for the inevitable property tax.

Receiving her PhD from Fudan University, she has been involved in both the public and private sectors. She worked at Guotai Junan starting in 2011 and rose to chief economist in 2013. She is also a part of CF40 and China Chief Economist Forum.

Zhu He 朱鹤 | CF40 Research Department deputy director

Fiscal expenditure has stepped up in H1 to fill gaps left by private sector woes, notes Zhu; how long this can be sustained is in question. The fiscal revenue gap will, on his estimate, be C¥2.83 tn. Under the premise of ‘revenues determine expenditure,’ something has to give. Zhu calls for an increase in the fiscal deficit, advancing and issuing more local government bonds or setting up infrastructure funds to ensure fiscal spending does not become a drag on the economy. This is necessary as global demand, amidst monetary tightening by the US Federal Reserve and other developed economies, is likely to decline.

Zhu obtained his PhD from the Chinese Academy of Social Sciences Institute of World Economics and Political Science. He joined CF40, one of PRC’s most prestigious private economic think tanks, as a ‘Young Researcher’ before becoming deputy director of the research department

Ding Zuyu 丁祖昱 | E-House Enterprise Group CEO

After a rough stretch, land is again showing financial signs of life in June, notes Ding: developer cash flows are improving. With private developers remaining cautious, state-owned buyers are still the big market players. They had been fuelling new projects with pre-sale funding but with sales falling, funding for new projects has dried up. The current rebound is minimal; decent land market recovery will revolve around attracting private sector developers. All factors will, he foresees, move in unison in future. Consumer confidence will slowly return, developer finance will improve, local governments will offer better land to improve land supply, drawing firms back into the market and creating a virtuous circle.

Ding received at doctorate in economics from East China Normal University before moving into the private sector. He is a founder and the current CEO of E-House Enterprise Group.