with risks mounting, Beijing's new paradigm builds a safeguard loop into the political economy to fend off decoupling or lesser shocks

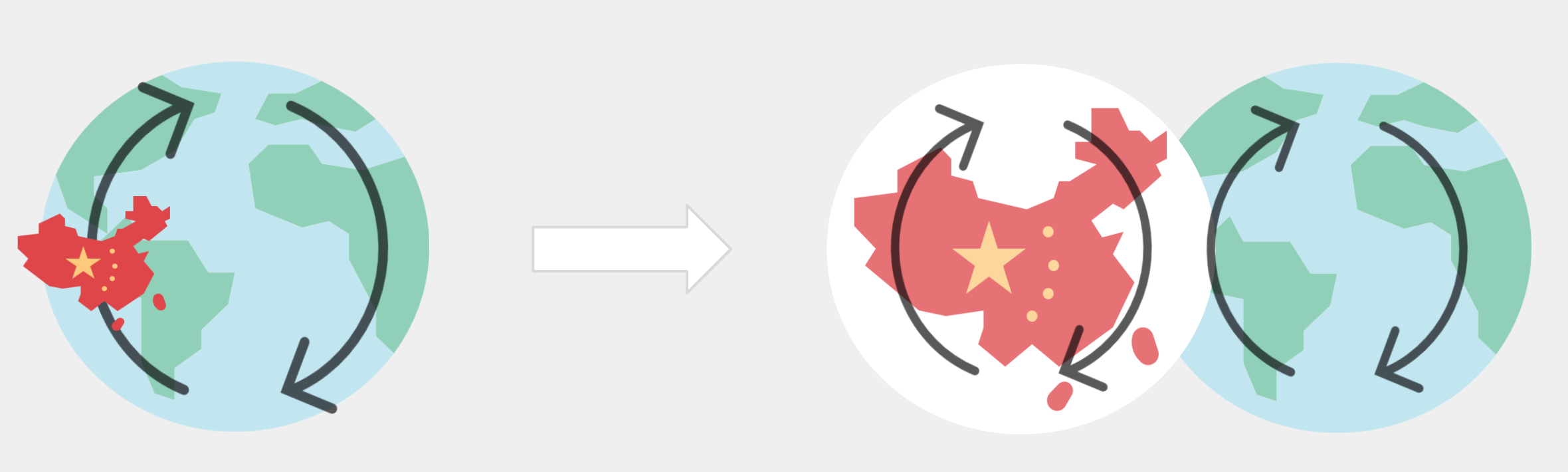

Stripped of head-scratching jargon, current talk by Xi and other top leaders of a ‘dual circulation' system imagines a two-ring economic circus, featuring a strong domestic ring and new avenues for international cooperation and competition. The two rings, suggest experts, are in normal times complementary but kept separate should external shock arise, will buffer the nation. The ‘self-reliance’ and ‘opening-up’ mantras are thus harmonised. Whether the result will work as well as the ‘great global circulation’ of the 1980s, is too early to tell. But, with MofCOM calling for input on this theme for the 14th 5-year plan, it flags a major shift in economic planning as global supply chains reshuffle.

‘dual circulation': the back story

‘dual circulation': the back story

A paradigm shift from the decades-old ‘reform and opening’, dual circulation transitions away from the impressive ‘great global circulation’ image influential in the Deng Xiaoping era. China’s comparative advantage in cheap labour could, argued Wang Jian 王建 State Development Planning Commission in 1987, spur export-oriented light industry (then leaving the Asian Tigers), embedding China in the global economy.

Then came COVID-19, numbing global supply and demand, and forcing a re-think of over-reliance on trade. Aiming for greater resilience, dual circulation puts reliance back on the domestic economy.

modernising the domestic circuit

Domestic circulation is beefed up via a two-pronged approach: actively regulated marketisation, and galvanising productivity.

Flagging its commitment to removing market barriers in May, Beijing nonetheless is keeping its hands on the strings. Industry policy should be less disruptive, more ‘inclusive’ and balanced with competition policy. Liberalising all factors of production including the latest, data, had already been called for in April, though other central concerns, not least national security, suggest a cautious approach.

visible hand in the NEV sector

State support is retreating. Purchase subsidies for NEVs (new energy vehicles) are to go in the coming years, with support retooled to focus on market failures like car-charging installations (‘new infrastructure’) and battery recycling. An emission trading scheme is being set up, market consolidation encouraged and the sector is opening up completely to foreign firms like Tesla and Volkswagen.

Beijing’s visible hand is still seen in setting new long-term goals in a forthcoming 15-year sector plan. Given low sales over the past year and its long-term goals in jeopardy, it has also extended (and in rural areas raised) purchase subsidies to encourage domestic production.

Making market actors more efficient, ‘new infrastructure’ will boost productivity. The term’s coverage has been gradually expanded since December 2018; together with industrial internet and other IT infrastructure it now also covers R&D facilities and upgrades to traditional infrastructure. A market-driven approach is preferred, avoiding overinvestment: Shanghai says it would only contribute one-fifth of the expected investment in its municipality. City clusters are prime beneficiaries: much of the new infrastructure, such as 5G, data centres and inter-city commuter trains, will raise their capacity and efficiency.

linkages: the heart of the matter

Where the two circulations intersect is where the policy vision gets harder. As foreign capital, tech and demand remain prerequisites for many sectors to grow, weaning them off external inputs is a fantasy in the near-term. Luring foreign capital to produce for China in China is the more rational end of domestic circulation. More pilot zones, modestly taxed and tariff-free, are being launched. Tesla and similar foreign firms are helping to build a self-reliant NEV and autonomous vehicle value chain. Foreign investment will soon flow into the tech-heavy STAR board via the Shanghai–Hong Kong Stock Connect. FDI is welcomed in many new infrastructure areas (subject to negative list and national security restrictions).

To secure demand for domestic producers via both circuits, Beijing is eager for more products geared to sell both at home and abroad. Easing conversion of domestic/foreign standards is in progress; to conserve a powerful industry policy tool, it will likely aim for transmutability rather than full harmonisation. So far, interim measures permit exporters to sell domestically in 2020 with reduced compliance barriers. Developing two markets at once is a tough task, not suited to all, commentators warn, not least because of vastly different targets.

capital market reform

Dual circulation entails capital market reform, Liu He 刘鹤 vice premier told the Lujiazui Forum. Capital markets need to improve to move from high-speed to high-quality growth, warns Xiao Gang 肖钢 former China Securities Regulatory Commission chairman, as US–China competition comes down to technology and finance. This aligns with policy measures of past years to improve domestic markets (STAR, ChiNext, NEEQ), promote RMB internationalisation and allow greater capital inflows. Protecting investor rights, argues Cheng Shi 程实 ICBC International, will nurture the domestic loop.

A more credible capital market will coax investment away from real estate. It would provide domestic demand a multiplier effect, high-tech development with support, and incentive for more US-listed Chinese firms to repatriate. Greater credibility would also attract more foreign capital to the home loop, adds Cheng. This however risks removing buffers between the rings; their absence was an issue in the first place. IPO registration and other capital market reforms are a priority in H2 2020.

outlook: best of both worlds?

Despite unheard of levels of attention to domestic supply and demand, the campaign to push China up the global value chain continues. Absent a final pandemic solution, the focus will be regional to north and southeast Asia. Tied to domestic upgrades, trade digitalisation and high-quality exports are ways forward. Some export sectors will indeed turn inwards, but finding new advantages is integral to the ‘dual circulation’ vision: in industries offering scale economies, high domestic demand would improve competitiveness of exports, explains Cui Fan 崔凡 University of International Business and Economics, reminiscent of Krugman’s home market effect.

Holding domestic demand as the trump card for future economic growth, ‘dual circulation’ is Beijing’s answer to reshuffling supply chains in a world of uncertainty and hostility. Whether it sufficiently marshalls inherent tensions in China’s ambitions, let alone proves workable is uncertain. Meanwhile, local officials are wielding the buzzword liberally.

what the experts are saying

Lu Feng 路风 | Peking University public policy professor

Universities and firms should be more than channels of foreign know-how, insists Lu Feng 路风 Peking University in his book New Fire 新火. A champion of indigenous innovation, he argues for hands-on experience. His work on aircraft and autos was pivotal policy in those industries. Working with foreign innovators is invaluable, but if unaccompanied by capacity building will cramp domestic efforts. Semiconductors, aircraft engines and other technologies are cases in point. Lu helped draft innovation strategies, not least the 2006-20 mid- to long-term sci-tech plan.

Cui Fan 崔凡 | UIBE China WTO Research Centre research director

A frequent commentator on pilot free trade zone and WTO issues, Cui cautions against misinterpreting domestic circulation as deleterious to FDI and trade policies. The ratio of FDI in investment and of exports in GDP decline with growth, but this does not mean closure. LSE-trained, Cui is also a senior consultant at Dentons Beijing.

Zhou Xiaochuan 周小川 | China Financial Forum president

PBoC governor 2002-18, veteran reformer Zhou was before that CSRC chair. He lobbies for Shanghai assuming functions of the US capital market. Its advantages lie, he notes, in a high savings rate providing capital. Continued focus on improving corporate governance, transparency, enhancing Stock Connects and further financial opening are necessary next steps.

CP note: icons made by turkkub, freepik, ultimatearm from flaticon